- Community

- Discussions

- Accounting

- Re: ST and Quickbooks Online setup for Georgia Sal...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

ST and Quickbooks Online setup for Georgia Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

07-13-2022 11:42 AM

We have been on ST for 3 months now and have yet to get our Sales Tax configured correctly. In Georgia we only charge tax on Materials and Equipment. There is no labor tax. For some reason ST will not calculate our taxes correctly. We have all of our materials listed as taxable in the pricebook, but the calculated amount on the invoice is always wrong. I know for certain that we are by far not the only Georgia company and that there is a solution, but our CSM and the accounting department are having trouble finding us an answer. Any fellow Georgians out there willing to lend a hand?

- Labels:

-

Tax Setup

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

07-15-2022 05:08 PM

Hi @nathan_coker! I work for ST Technical Support in Atlanta and would love to help if possible. Check your DMs!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

07-14-2022 10:43 AM

Hi @nathan_coker If you are close, we are probably on the right track. I would suggest starting a chat session with support to look at all of the elements here. They can look directly at the data, so no guess work as to tax rate or labor rate actually used on the job. Given that, they should be able to determine exactly what is happening so you can set your data accordingly. Good luck.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

07-13-2022 12:55 PM - edited 07-13-2022 12:58 PM

Hi @nathan_coker. Not a Georgia contractor, but the concept is universal. On the tax zones table, (settings --> tax zones), for each tax zone click on the "Charge different tax rate for labor and materials" button. That will open up a tax rate for materials and a different tax rate for labor. Change the labor rate to 0. To expound beyond this, in our implementation, the customer is billed for tasks, not equipment and labor. Those things are cost of goods sold, not sales amounts. So if that is your setup, create taxable and non-taxable tasks, putting what you are charging for labor on the non-taxable and everything else on the taxable tasks. Hope this helps.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

07-13-2022 01:33 PM

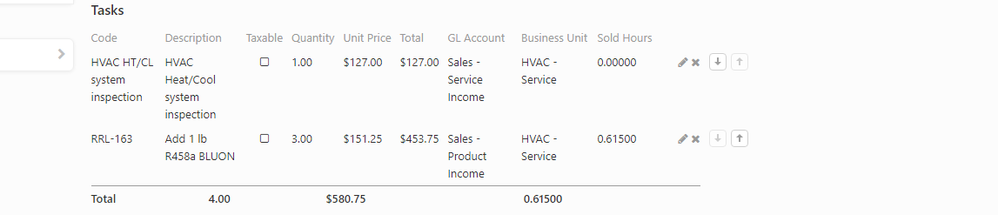

Thank you for this advice Michael! Unfortunately, we are already doing all of this. For example, we have an invoice that has our cost on the material as $75, the customers price on material $453.75, and the overall invoice price as $580.75. The tax rate for their area is 8%. ST is calculating that the sales tax as $21. $21 isn't 8% of any of those numbers, so I'm not sure how it is calculating it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

07-13-2022 02:09 PM

Hi @nathan_coker. When you say that the customers price on materials is $453.75 and the overall is $580.75, I guess that means labor is $127. How are you putting this on the invoice, specifically what tasks and what dollars for each task are included on the invoice?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

07-13-2022 02:59 PM

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

07-13-2022 03:09 PM - edited 07-13-2022 03:16 PM

So try this and see if it works. The system charged $21 in tax. At 8%, that means taxable sale was $262.50. Looking at your tasks, I am guessing that the system inspection task is marked as not taxable, so no tax on that. The R485A has a price of 453.75 but the labor portion of that should be the labor rate times the 0.615 sold hours that are assigned to that task, times the quantity of 3. Does subtracting the calculated labor from the $453.75 get you anywhere close to 262.50?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

07-14-2022 10:07 AM

Michael, I see what you are saying. I thought that you may have figured it out. It did get close on this particular example. $21 would have been 7% sales tax instead of 8%. After seeing this, I started looking at several other invoices and checking them, they are all over the place. I'm beginning to think its a glitch within our account or software.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

07-13-2022 03:00 PM

Does this help? The HVAC inspection task is all labor and not set as taxable. The Bluon is set as material with no labor and is taxable.

- Variances between Service Titan sales tax calculations and QuickBooks Online sales tax calculations in Accounting

- Integration - QuickBooks Online in Titan Lounge

- Switch to QBO to prepare for Accounting Reimagined? in Accounting

- Quickbooks Online Income Reports to Match Service Titan Revenue Reports in Accounting

- Online Quickbooks Class Issues in Titan Lounge