- Community

- Discussions

- Memberships or Service Agreements

- Re: Zero Ticket Invoices - Recurring Services

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

05-25-2022 06:40 AM

Currently when we run a Recurring Service that is paid monthly (the visit is only twice a year) the Invoice shows as a Zero Dollar Job. Is this normal, or should there be a way to show that this service is actually being paid for through the Membership? I don't mind if it's normal to have this, and to manage and budget for it, but I wanted to see if there was a better way to have more accurate information since they are actually paying for the Recurring Service, just not at the time of the visit.

Solved! Go to Solution.

- Labels:

-

Membership Reporting

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

05-25-2022 08:57 AM

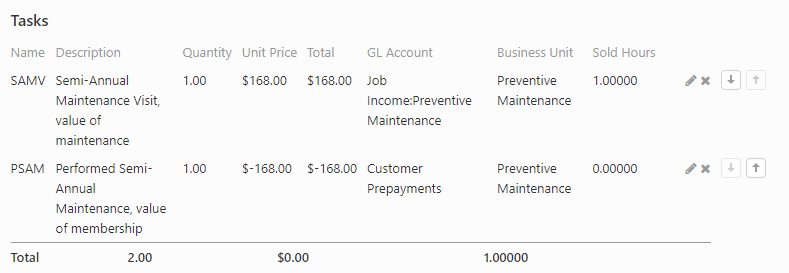

Our memberships all go to a liability general ledger account at the time of sale or billing (for monthly) as directed by the sale/billing task. When we are performing the service, there are two tasks that direct the money into job income. We call the first task something like "Annual maintenance visit" (we have several for different types of memberships but they work the same) and that task directs the value into job income. The second task is "Performed Annual Maintenance" and removes the value from the liability account. So these two tasks wash each other out and the balance is zero on the invoice, but once exported to QB, the money pulls from the liability account to job income.

I set all these up when creating the memberships, so they automatically go onto the invoice when scheduling the recurring services. I'll see if I can attach a screenshot of the invoice so you can see what I mean.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

05-26-2022 10:34 AM

We have multiple memberships set up this way with a single visit but clients pay either monthly or annually.

We have it set up so that all of the membership payments go into a prepaid liability account in Quickbooks for that service and then have the service invoice template set up with a postive and negative amount for the value of the service. This way when the service is completed, there is still technically a $0.00 invoice, but the Positive Sales Task indicates in Quickbooks that revenue has been made for that service and is associated with our regular income account for that service, and the Negative sales task removes the money from the prepaid liability account as the service has now been completed. You could do the same thing for multiple visit appointments assuming the invoice template is set up accordingly.

For example if Service A has a total value of $100.00 and there will be two visits each season you could set it up so that the invoice template for that recurring service has a Positive Sales Task for $50.00 that is linked to go to your income account for that service normally, and then a Negative Sales Task for $-50.00 that is linked to a prepaid liability account, as each service is completed the books should show that the revenue has been recognized and your liability account will show that the amount has been removed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

05-25-2022 08:59 AM

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

05-25-2022 08:57 AM

Our memberships all go to a liability general ledger account at the time of sale or billing (for monthly) as directed by the sale/billing task. When we are performing the service, there are two tasks that direct the money into job income. We call the first task something like "Annual maintenance visit" (we have several for different types of memberships but they work the same) and that task directs the value into job income. The second task is "Performed Annual Maintenance" and removes the value from the liability account. So these two tasks wash each other out and the balance is zero on the invoice, but once exported to QB, the money pulls from the liability account to job income.

I set all these up when creating the memberships, so they automatically go onto the invoice when scheduling the recurring services. I'll see if I can attach a screenshot of the invoice so you can see what I mean.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

05-27-2022 11:05 AM

This seems to be the perfect solution. Is this what people refer to as deferred revenue?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

05-27-2022 11:09 AM

Hi Brad, this is indeed Deferred Revenue.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

05-25-2022 07:47 AM

Other than comments, I don't think there is a way to specifically link the maintenance call to the recurring billing. As an alternative, I would suggest that you set up a business unit. We have done so and call it HVAC Maintenance. All recurring billings, (monthly and annual both), are coded to this business unit. Then, all preseason maintenance calls, both cooling and heating, are also charged to this business unit. Then, when we look at a maintenance call, we know it is for recurring service because that's the business unit it is in. When we look at our financials, we see the revenue from the recurring billings and the expense from the preseason maintenance calls, thus giving us an idea of the profitability of this service. Hope that helps.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

05-27-2022 11:04 AM

That is currently how we are set up. We are supposed to have a different GL account as well (as others are suggesting), but I'm not sure where we're at with that yet. Thank you!

- Order of Items on invoices in Estimates

- Expandable & Customizable Service Descriptions for Estimates & Invoices in Estimates

- more options for recurring service in Memberships or Service Agreements

- Membership Billing different from invoices for service calls in Memberships or Service Agreements

- Reopening exported jobs in Accounting